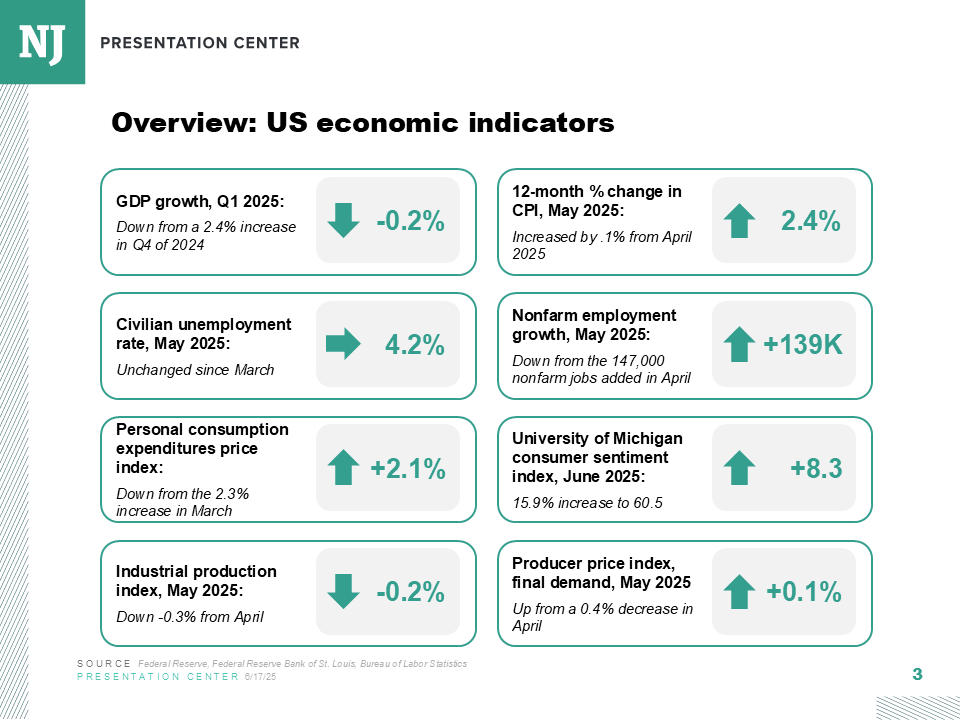

The latest reading on the path of consumer prices is due out Tuesday morning, and it’s likely to show no big spike in prices.

But consumers and investors will still be nervous about inflation’s future. Very nervous.

The Inflation Nowcast, published by the Federal Reserve Bank of Cleveland, sees the latest report showing a 0.2 percent change in overall prices in December. The annual rate for 2025 is forecast at 2.57 percent.

Most independent forecasters see prices moving up at a rate of 2.5 percent to 3 percent this year. No one expects any return to the double-digit annual increases of the 1970s or the 9.1 percent peak of June 2022. But there is serious concern that inflation is far from being tamed, and far from the 2 percent annual rate the Federal Reserve has sought for years.

The key reasons for the uncertainty: Tariffs, immigration, and cheaper money. The outlook:

Money

“We are shifting to easy monetary conditions,” said Clement Bohr, a macroeconomist at the UCLA Anderson School of Management.

The Fed is focusing more on keeping people employed, he said, and its policies are “a recipe for not bringing inflation down to its target.”

The Fed lowered its target rate last year, and it’s now at a range of 3.5 to 3.75 percent. Banks use the rates to loan funds to each other overnight, and the rate tends to be a benchmark for other rates. In theory, the more money pours into the economy, the more sellers and services are inclined to raise prices.

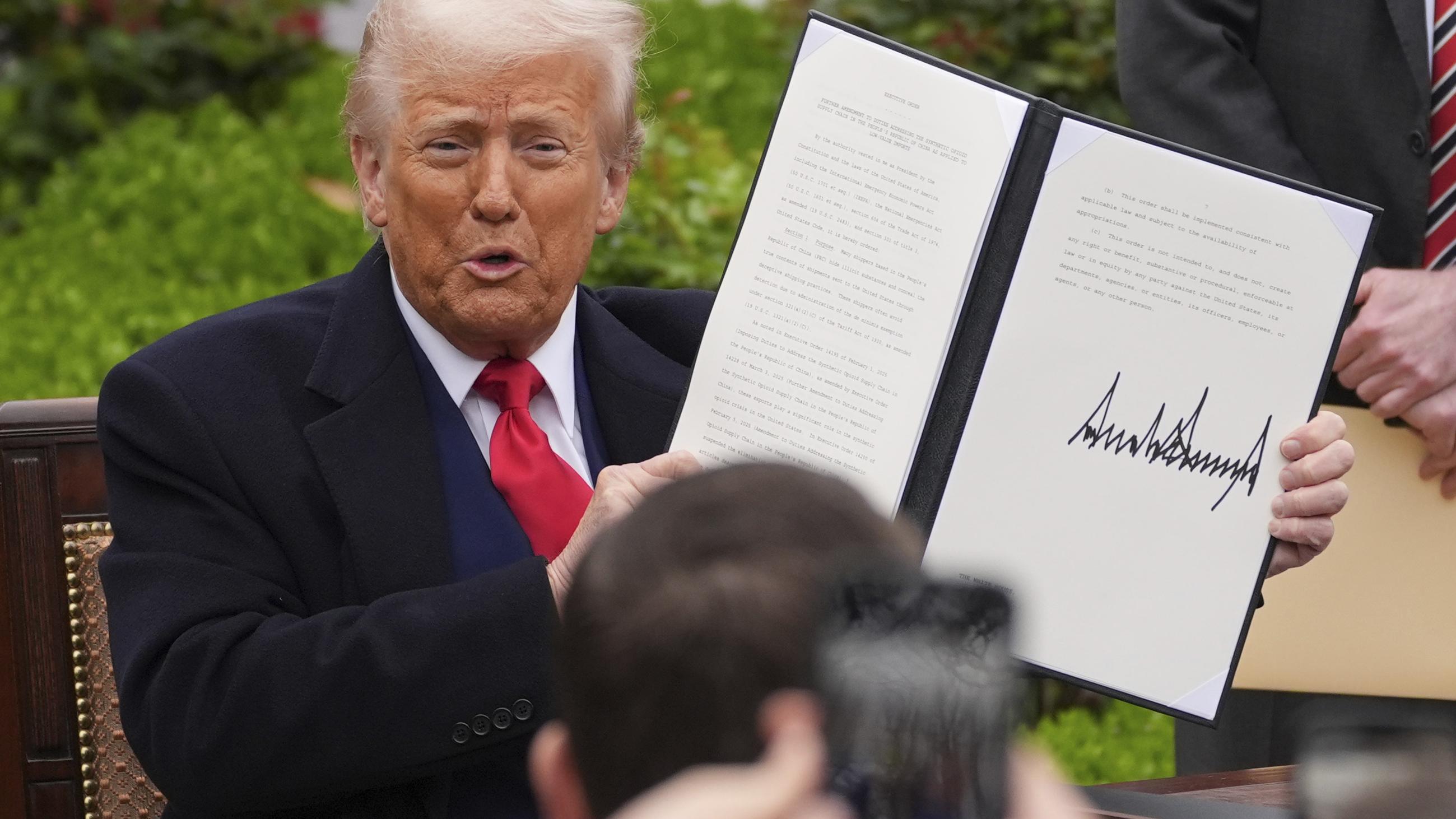

President Trump has aggressively sought to have the Fed lower rates. The term of Jerome Powell as chairman ends in May, giving Trump a chance to replace him with someone more aligned to the president’s view.

But the Powell-Trump war over policy escalated notably Sunday, when Powell said the Justice Department had served the Fed with subpoenas involving his testimony last year about renovations to the Federal Reserve Building.

In an extraordinary response, Powell said in a video statement on Sunday night that “this unprecedented action should be seen in the broader context of the administration's threats and ongoing pressure." Two Republican senators—Thom Tillis and Lisa Murkowski—forcefully pushed back against the DOJ probe, escalating the drama around the independent agency’s future.

Tariffs

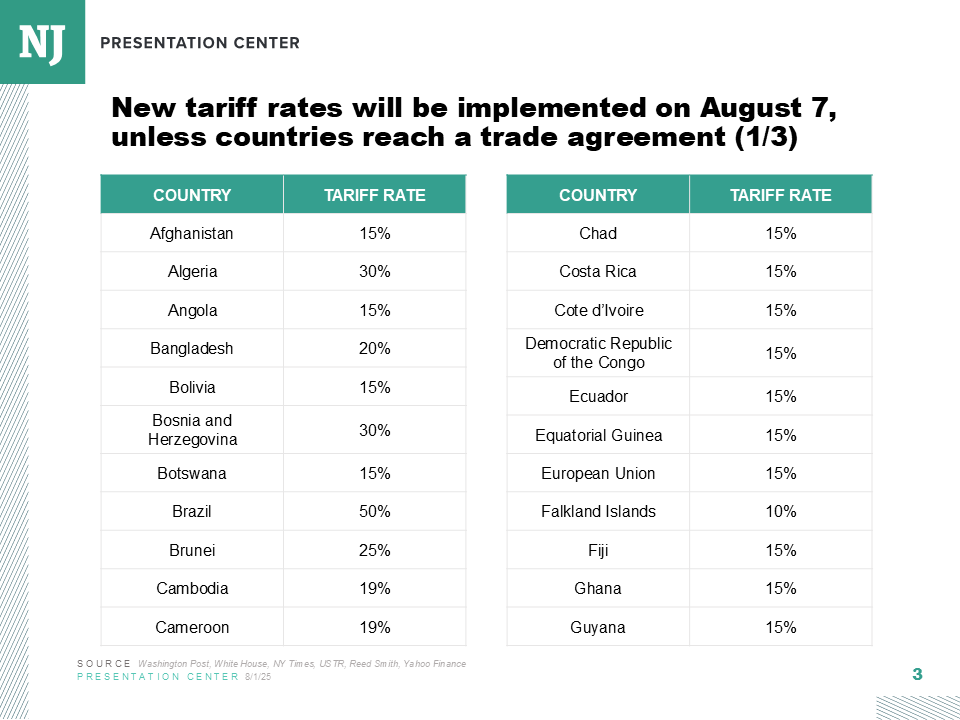

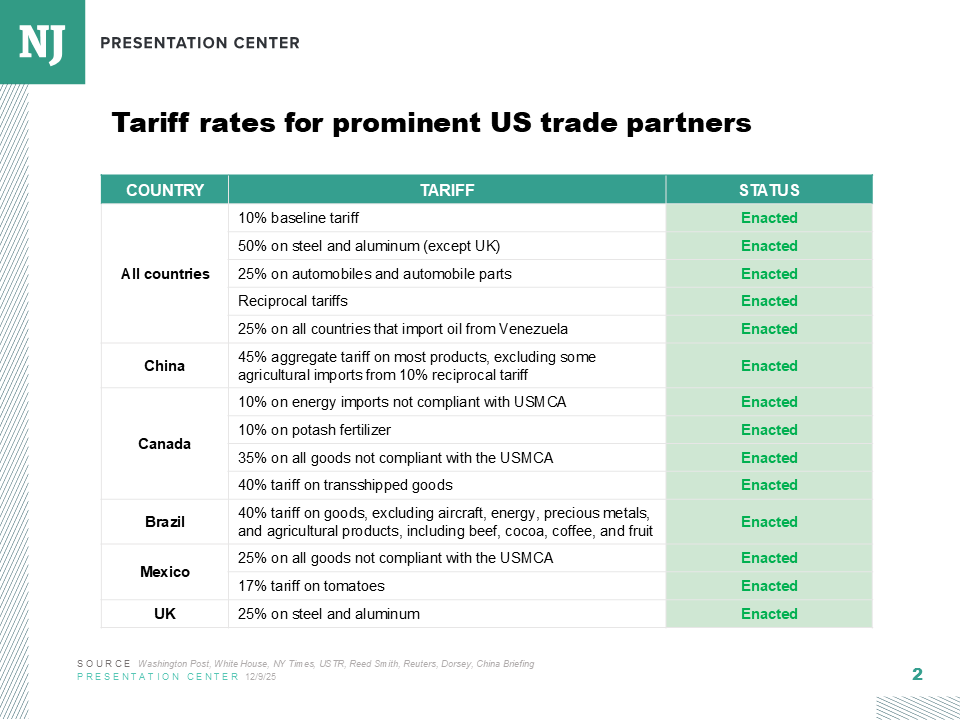

So far, the impact of the tariffs announced by Trump throughout last year has been less than expected. Companies have often been reluctant to pass the tariff costs on to consumers as is usually the case, and have found ways so far to avoid paying them at all.

“Many importers do not pass the rising cost of new tariffs on to their customers until inventory used for production bears the higher cost,” said an analysis by the Peterson Institute for International Economics, which noted that “old inventory is not marked up to reflect the tariff cost of new inventory."

"Given that practice," the analysis added, "the impact of higher tariffs on consumer prices (measured by the consumer price index or the personal consumption expenditures price index) is delayed for several months after the tariff announcement.”

Those delays are likely to end, said Bohr, if the tariffs continue and sellers continue to feel financial pressure. He estimated that the tariff pass-through will increase, perhaps adding another half a percentage point to the cost of goods.

Immigration

Add to all these threats a hard-to-predict labor market. Immigration is down, meaning the demand for certain jobs has to be filled by a smaller pool of people.

That’s a situation that historically drives up wages, which in turn tends to drive up prices.

None of these threats to stable prices suggest the sort of uncontrollable spiral that would trigger a recession.

The fate of inflation and the overall economy rests largely on consumer sentiment. Consumers drive the economy, and at the moment they’re not optimistic. The Conference Board, a nonpartisan organization that regularly surveys consumer sentiment, found last month that its expectations index remained below 80 for the 11th straight month.

The index gauges consumers’ short-term expectations for income, business, and labor-market conditions. The below-80 reading is “the threshold below which the gauge signals recession ahead,” the board said.

There are some reasons for cautious optimism about prices. The cost of housing is largely stabilizing, as mortgage interest rates slowly drop.

“The biggest trend that we’re most excited to see is an improvement in affordability,” said Danielle Hale, Realtor.com chief economist.

But fewer than 1 in 5 consumers expected their incomes to increase over the next six months. Consumers anticipating a decrease rose to 14.7 percent from 12.5 percent in November.

“Consumers appeared more cautious about plans for buying big-ticket items over the next six months,” said Dana Peterson, Conference Board chief economist, in a press release.

All these issues mean an uncertain but not necessarily scary time for prices.

“While we believe inflation will be higher and more volatile than it has been in recent years, we do not expect a reprise of 2022-style price hikes,” said a JP Morgan Chase analysis.