Don’t go spending any $2,000 tariff dividend yet. Don’t even dream about it.

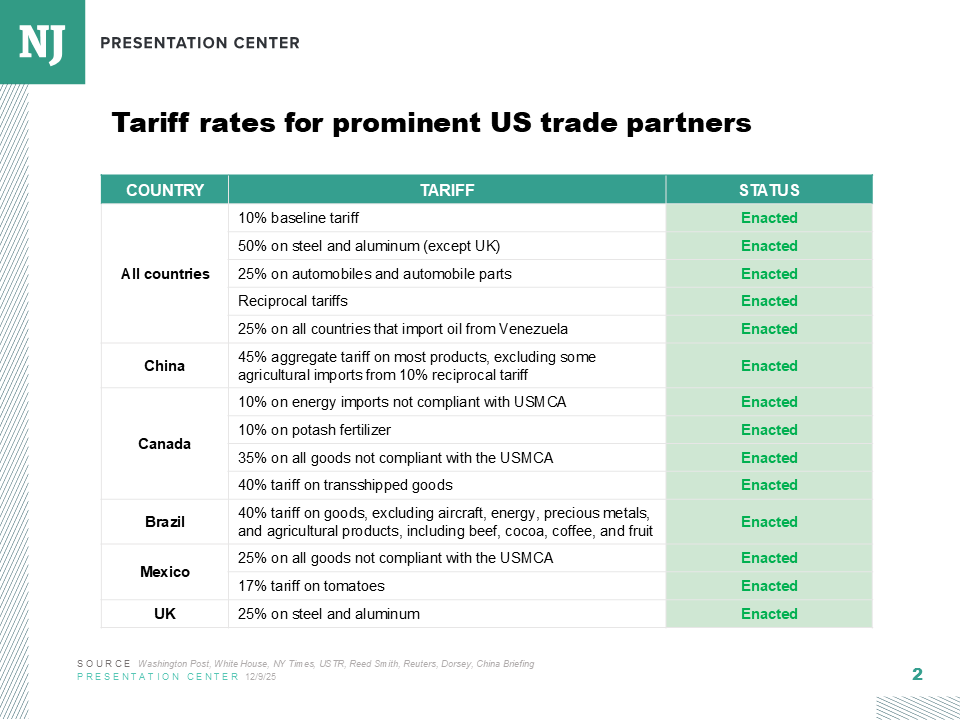

President Trump’s tariff policy is in turmoil. The Supreme Court is weighing a case (Learning Resources, Inc. v. Trump) that could determine its future. Tariffs seem to come and go. Congress has yet to act decisively on tariff policy. And there are serious questions about whether tariffs will yield the windfall needed to pay for any consumer relief.

For weeks, the Trump administration has tossed around the idea that revenues from its increased tariffs will lead to a $2,000-per-person dividend.

There are no specifics yet, but Kevin Hassett, director of the president’s National Economic Council, told CBS’ Face the Nation last month that Trump will present a plan soon to Congress.

Hassett cited solid recent economic growth. “In the summer, I wasn't so sure that there was space for a check like that. But now I'm pretty sure that there is,” he said.

But boy, are there hurdles to overcome. A sampling:

How is the dividend paid for? Trump has touted the checks as the bounty from the big tariffs he’s been pushing since his Rose Garden announcement in April. The U.S. collected more than $200 billion in tariffs between Jan. 20 and Dec. 15, according to Customs and Border Protection.

But Erica York, vice president of federal tax policy at the Tax Foundation, a Washington-based research organization, said: “The rebates could not be paid for by tariffs that have come in so far, even if the rebates are only paid to people earning below $100,000. It would take multiple years of tariff revenues to fund a one-time $2,000 rebate.

“Even if all tariff revenues, including pre-existing and new tariffs, went toward rebates, revenue would still fall short,” York said.

Who gets the help? Trump said in a Truth Social post last year that higher income earners would not get the break. Others in the administration have suggested the dividend would be available to households who make less than $100,000.

The Tax Foundation looked at three possible options:

- $2,000-per-person payments that have a hard cutoff of $100,000 for all filers.

- $2,000-per-person payments that begin phasing out at a 5 percent rate above $100,000 for all filers.

- $2,000-per-person payments that begin phasing out at a 5 percent rate above $150,000 for joint filers, $112,500 for head-of-household filers, and $75,000 for single filers.

Even when including estimates of collections at the end of the year, “tariff money would not pay for even the narrowest tariff dividend option,” the Tax Foundation analysis said.

Would a dividend offset the higher prices consumers could pay as tariff expenses are baked into the price of goods?

The nonpartisan Yale Budget Lab estimated in November that consumers face an overall average effective tariff rate of 16.8 percent, the highest in 90 years.

The dividend could help some people. “On average, a flat per-person $2,000 dividend could more than cover low-income families’ tariff costs but not those of higher-income families,” said an analysis by the nonpartisan Tax Policy Center.

Progressives argue that the whole dividend idea is misguided.

“When you put together the tariff, tax and spending policies of this administration and this Congress, you can't avoid the fact that they redistribute resources to the rich from everyone else in the U.S.,” said Steve Wamhoff, federal policy director at the left-leaning Institute on Taxation and Economic Policy.

“Trump's attempts to obscure that with half-baked proposals like a tariff dividend that don't make sense will never work,” Wamhoff said.

What about the unknowns? Can the government rely on a steady flow of tariff revenue? Will the international economy experience a downturn? Will U.S. companies adapt and make more products domestically, negating the need for tariffs?

“Frequent changes to tariff rates make it hard to design the most effective offsets when finally enacted and implemented,” the Tax Policy Center said.

Trump has repeatedly said he’d impose certain tariffs and then backed off. One of his last official acts last year was to delay hikes in tariffs for upholstered furniture, kitchen cabinets, and vanities for another year. A White House fact sheet said “productive negotiations with trade partners” were continuing.

What role could the Supreme Court and Congress play? The Court has yet to weigh in on the administration’s tariff agenda. It heard the Learning Resources case on Nov. 5 and is expected to decide early this year whether Trump exceeded his authority by declaring a national emergency that justified the tariffs.

Congress could also prove to be a slog. Democrats next year will be focused largely on relief to middle- and lower-class families. Republicans like big tax cuts, but they also prioritize deficit reduction. That’s supposed to mean restricting spending and pushing policies that promote economic growth.

But York maintained flatly: “No, a tariff dividend will not grow the economy. Rebating money back to taxpayers would provide relief, but it would not offset the economic damage of tariffs.

“Tariffs reduce returns to work and investment in the United States, which is why they shrink economic growth. Sending checks to people does not remove those disincentives.”