Michael Cannon is the libertarian Cato Institute’s director of health policy studies. He has been a loud critic of the Affordable Care Act, authoring a book in 2013 that outlined how states could stop the implementation of the law. He spoke with Nancy Vu about what he believes to be the shortfalls of the ACA’s enhanced premium tax credits—the issue at the center of the current government shutdown—what reforms to the marketplace are needed, and his argument for why the subsidies should lapse. This interview has been edited for length and clarity.

We’re talking about the enhanced premium tax credits that were introduced in 2021 for people enrolling in plans through the ACA marketplace, and later extended through the end of 2025. What do these enhanced credits do and who receives them?

These credits primarily subsidize people who are not needy. They subsidize people typically making more than $100,000 per year. Under the original Obamacare, a family of four would qualify for subsidies even if they were making $128,000 per year. But if they were making $129,000, they wouldn’t. What the enhanced subsidies do is they subsidize people making from $129,000 all the way up to $600,000 per year. And so these are really the Obamacare subsidies for the wealthy.

In what we call the “enhanced subsidies” there is a sprinkling of extra money for people with moderate incomes, but that’s not the bulk of it. That’s not the part that offends people. The part that offends people is that Obamacare is still so unaffordable that people earning $129,000, $200,000, $300,000, $400,000, $500,000 a year still can’t afford it—and that’s why the government is subsidizing them.

So what these subsidies are really showing is that Obamacare has been a total failure when it comes to making health insurance affordable. All it’s done is make health care and health insurance less affordable.

What was the original intent behind the premium tax credits in 2010, when the ACA was enacted, and then the intent of enhancing the credits during the pandemic?

So, you will notice that I never call them tax credits. I only call them subsidies—both because they’re not tax reduction, they’re just government spending, but also because calling them tax credits has been part of a massive scheme to hide from voters what Obamacare does.

The first thing they did was they said, “because it would be unpopular to raise taxes on the healthy in order to subsidize the sick, we are going to hide those taxes in health-insurance premiums by telling insurance companies they have to charge healthy and sick people in their given age the same premium for the same plan.” So the premiums for the healthy cannot be any lower than the premiums for the sick. And what that does is it increases premiums for the healthy.

But that’s destabilizing, because if the healthy opt out, then the average risk in the risk pool gets riskier, more expensive, and premiums go up. Then more people opt out until the market collapses. So the rest of Obamacare’s private health-insurance provisions are all just efforts to prop up those hidden taxes and hidden subsidies, and prop up the market so it doesn’t collapse.

So the short version: This is a failed law that offers overpriced junk coverage, and the subsidies are there to paper over all those failures.

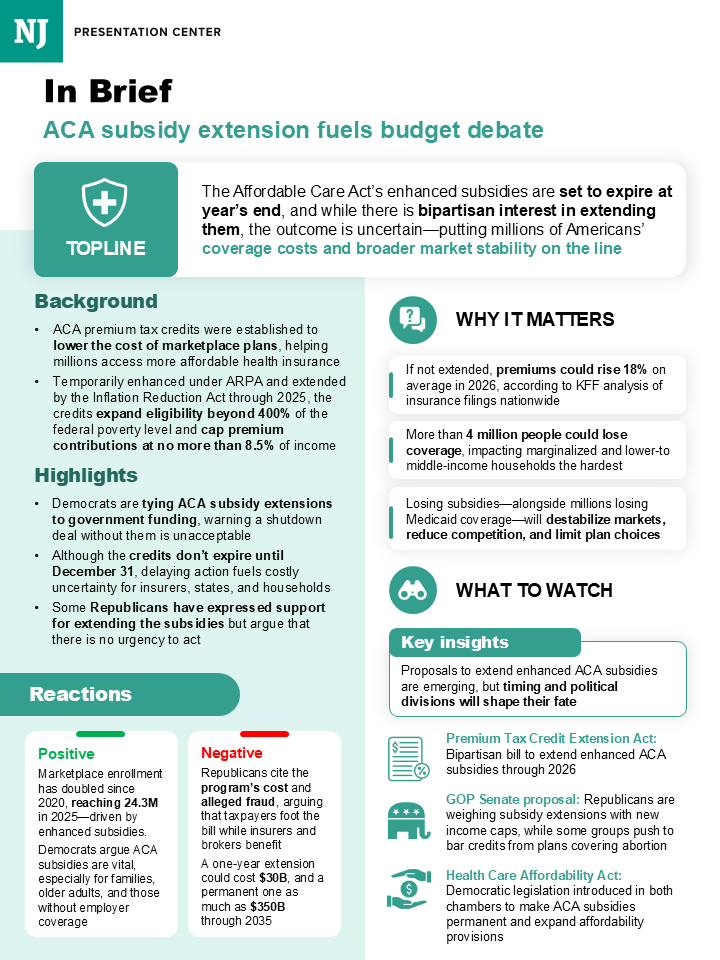

What’s going to happen if the enhanced premium tax credits lapse?

The first thing that happens is, those subsidies disappear, so wealthier people will see the full cost of Obamacare plans, and then more of them will reject Obamacare as overpriced junk coverage. The people who are most likely to reject that coverage are healthier people, which means the risk pools will get sicker and the premiums will go up.

The original Obamacare subsidies will remain. They will remain for low-income people, and they will rise with the premiums. So when the premiums rise, those original Obamacare subsidies will grow with the premiums, and the people who remain in Obamacare won’t have to pay any more than they did under original Obamacare—at most, 8.5 percent of income. So it’s not going to throw them off their health insurance. It’s just going to take Obamacare back to where it was in 2020.

What about the timing? There’s been a lot of talk about the effects of lawmakers not renewing the enhanced subsidies by Nov. 1. Will people have to shop around and pay higher premiums if the enhanced premium tax credits are not extended by open enrollment?

So if the government hasn’t authorized spending for these subsidies for the wealthy, then insurance companies and the health-insurance exchanges have to present enrollees with information that reflects current law at the time of enrollment—which means those subsidies for the wealthy won’t be there. They have to increase the premiums that they’re charging to reflect what they expect will be people’s reactions to subsidies not being there, and more of the cost of the law being transparent to people.

The filings the insurance companies have submitted say they’re going to be increasing the premiums by 18 percent on average. And KFF has said that about 4 percentage points of that will be because the subsidies for the wealthy disappear.

But what that 4 percent signifies is part of the cost of Obamacare becoming more transparent. And it’s important to keep in mind, that’s not the lion’s share of the premium increase. Premiums are going to be rising by another 14 percentage points regardless, because of the underlying failures of this law, failures to make health insurance more affordable.

Is it harder to reform the market than reforming the subsidies?

There’s certainly an opportunity for a grand bargain here that would preserve subsidies for people who need them, and reform the market so that health insurance would become more affordable, so that fewer people would need subsidies. To do that, we would need to let people purchase health insurance that’s not subject to all of Obamacare’s rules.

In U.S. territories, health insurance is not subject to these rules. In the short-term market, same thing. In countries like Germany, people can buy health insurance that is not subject to these hidden taxes—what we call community-rating price controls—and so they charge healthy people lower premiums, and then provide them secure, lifelong coverage.

We can do these things and still provide subsidies for those who cannot provide for themselves, and it would be a lot less expensive than preserving these subsidies for the wealthy.

There are some reforms being floated around to change the subsidies—specifically, a $200,000 income cap on those eligible for the credits. What do you think about that idea? Do you think it would be sufficient to address the issues you mentioned before?

Absolutely not. Every time you provide charitable assistance, you run into what economists call the “Samaritan’s dilemma”—which is, you don’t want to help too little, but you don’t want to help too much. If you help too little, people suffer. If you help too much, people don’t take care of themselves. And there’s no obvious place to strike that balance. But every private charity and every government program that tries to provide assistance to people below a certain income level runs into this problem.

And when we’re talking about a different percentage of income that people have to pay toward their Obamacare plans—which, if you change that percentage of income, it changes the amount of the subsidy they receive—what that does is the subsidy creates a disincentive to work. That creates a disincentive to increase your income and climb the economic ladder. And then, if you have a cap to that, instead of just having a gradual phase-out of the subsidy and a gradual disincentive to work, a cap creates what they call a cliff.

What if you’re getting a $12,000 subsidy, and you have an opportunity to increase your income from $199,999 to $200,000? Well, for the crime of earning that additional dollar of income, you lose a $12,000 subsidy. So that creates a big disincentive for you to do more productive work and help more people and provide more for yourself. And that’s a very perverse incentive.

These things are not solutions to the problem.

What about requiring ACA enrollees to pay a minimum premium and barring zero-premium plans?

So there’s this moral-hazard problem where people are going to make wasteful decisions. A very important subset of that moral-hazard problem is fraud. When people enroll in an Obamacare plan, including when they switch from one plan to another, oftentimes some broker gets paid. When people are not paying any of the premium themselves, it is much easier for unscrupulous brokers to enroll people in plans who don’t want to be there, who are ineligible, who might not even know that the broker is enrolling them in a plan, or who might be enrolled in a different plan.

All these subsidies are going straight to the insurance companies. And every time you have these zero-premium plans, the insurance companies are making out like bandits as well.

And it’s not harmless to the enrollees. Oftentimes, what they will find is they might report their income a certain way, and it ends up being higher than they thought it was going to be, and they owe money at the end of the year that they didn’t know they owed. They wouldn’t have signed up for the plan if they’d known they were going to owe money. They end up suckered into these situations where they help an insurance company and then get hit with a bill they never wanted come tax time.

What do you think are adequate reforms to not only reform the market, but change how these subsidies look?

I don’t think there’s any salvaging these subsidies. The only really good thing you can do with these subsidies is eliminate them.

The most important kind of assistance we can provide to people who are having a hard time affording health insurance is to get all the Obamacare regulations out of the way. Because if you do that, then premiums will plummet by 50 to 60 percent for most people in the exchanges, bringing health insurance within the reach of people who cannot afford Obamacare by themselves.

Now, wouldn’t that be wonderful if they could afford health insurance without government subsidies?