Health care is at the heart of this month’s government-funding showdown.

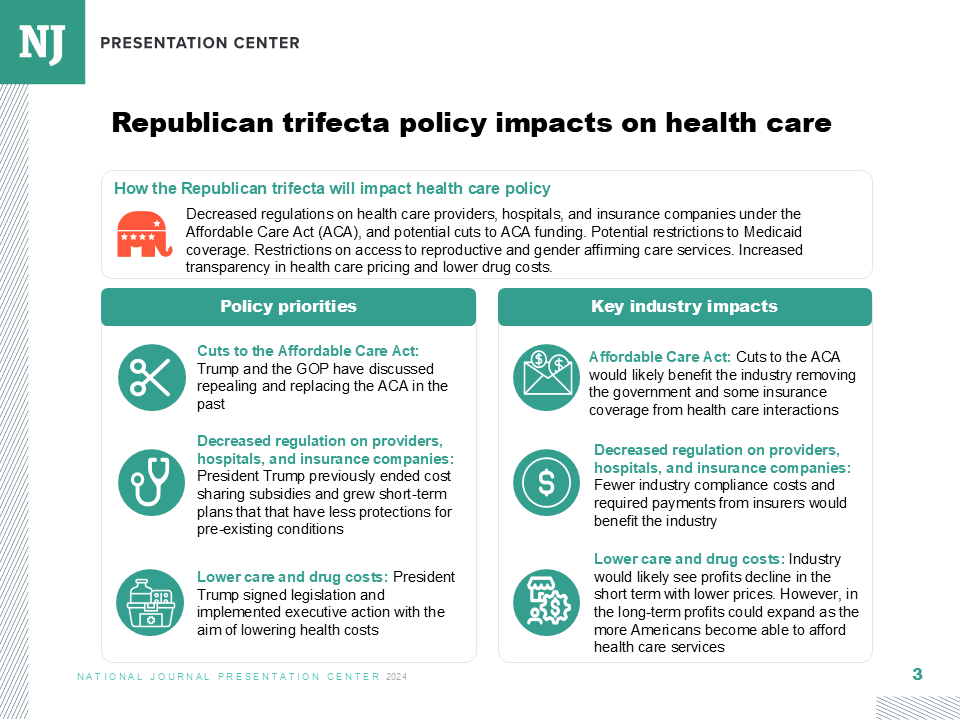

Democrats and a number of Republicans are looking to tie keeping the lights on beyond Sept. 30 to an extension of the Affordable Care Act’s enhanced premium tax credits, which are set to expire at the end of the year. Democratic leadership is pressing for an extension of the enhanced premium tax credits to be included in any stopgap funding measure—running afoul of some Republicans who are calling for a “clean” continuing resolution.

“The bottom line is the bill they proposed can’t get our votes; it doesn’t meet the needs of the American people,” Senate Minority Leader Chuck Schumer told reporters Wednesday. “That has to be in that bill. Their proposal does not do that.”

House Minority Leader Hakeem Jeffries echoed the sentiment on Wednesday, suggesting a clean CR was a nonstarter for Democrats.

This clashes with comments from Senate Majority Leader John Thune, who suggested earlier this week he believes that a “clean CR” would be the best step forward to give room for the appropriations process to run its course through regular order. House Speaker Mike Johnson said on Tuesday he would rather couple any stopgap funding bill with a package of three appropriations bills, along with updated allocations for several agencies sent over by the White House through an “anomalies” request.

The two sides are miles apart on a deal, and seem to have internal divisions on what to demand at the negotiating table.

Democratic leaders are facing pressure from their party—along with their constituents—to present a more muscular response to Republicans as the Trump administration continues to centralize power within the executive branch at the expense of Congress and the courts. Schumer, along with other Senate Democrats, has been under fire from his party for voting for a government-funding deal back in March that seemingly left Democrats empty-handed, while all but one House Democrat had voted against the measure.

Schumer and Jeffries signaled Wednesday morning that—unlike in March—they are on the same page in opposing a clean CR, with Schumer noting the pair speaks several times a day. Both Democratic leaders were planning on meeting later that night to consider a strategy for government funding. That meeting, however, was cancelled due to House votes going longer than expected, according to a spokesperson for Schumer.

Republicans don’t seem to all be on the same page, either.

Members of the conservative faction of the House conference have been publicly against renewing the enhanced subsidies, arguing the tax credits served their purpose during the COVID-19 pandemic but can expire now that the pandemic is over. But front-liners in swing districts are putting pressure on leadership to allow for an extension, arguing that the premium spike that’s expected to come from the subsidies’ expiration would cost them in the midterms.

“They should go away,” House Freedom Caucus Chair Andy Harris said Tuesday of the enhanced premium tax credits. “COVID is over.” Budget Chair Jodey Arrington echoed that sentiment, arguing that the measure isn’t good policy.

Eligibility for the PTCs and the subsidy amount were expanded by the 2021 American Rescue Plan, allowing those with incomes 400 percent above the poverty line to obtain the credit. The Inflation Reduction Act of 2022 extended those subsidies through 2025.

The premium tax credits will stay in place even if the enhanced subsidies expire. But premiums are expected to skyrocket by more than 75 percent on average for enrollees, a jump that’s expected to leave 4 million more Americans uninsured, according to an analysis from KFF.

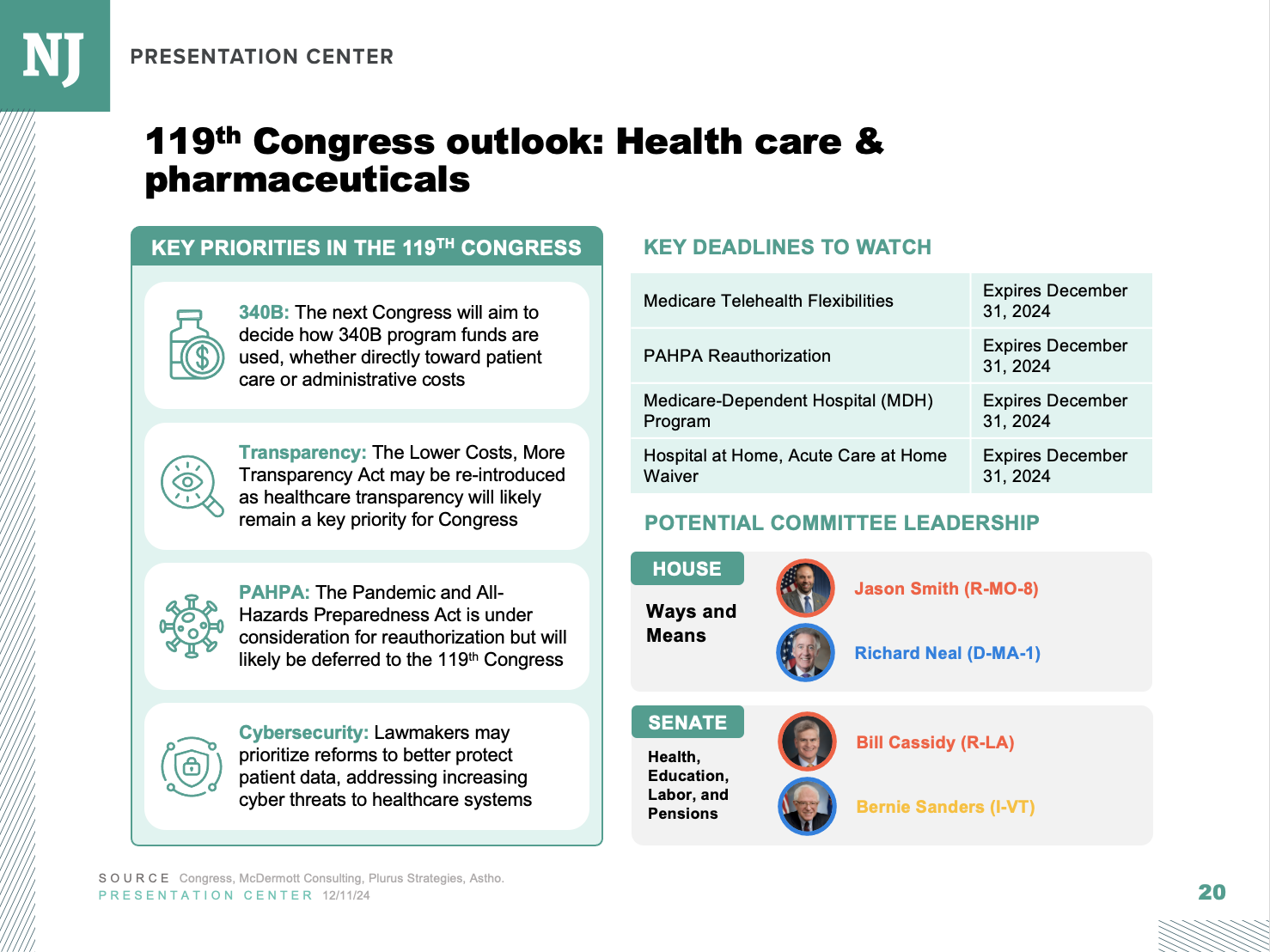

Rep. Jason Smith, chair of the House Ways and Means Committee, which would consider the tax credit’s extension, told Bloomberg TV that a deal with Democrats on the enhanced subsidies' extension was possible, but he pressed for income limits for eligibility.

And just last week, House moderates, led by GOP Rep. Jen Kiggans and Democratic Rep. Tom Suozzi, introduced a bipartisan bill that would extend the enhanced premium tax credits for one year.

“While the enhanced premium tax credit created during the pandemic was meant to be temporary, we should not let it expire without a plan in place,” Kiggans wrote in a statement.

A number of vulnerable members from both parties signed onto the bill, including GOP Reps. Brian Fitzpatrick, Jeff Hurd, Rob Bresnahan, Young Kim, David Valadao, Tom Kean, Juan Ciscomani, and Maria Elvira Salazar. Vulnerable Democrats joined as well, including Reps. Jared Golden, Don Davis, and Marie Gluesenkamp Perez.

But ultimately, Congress will need buy-in from President Trump before moving forward with any deal to extend the tax credits and fund the government. While Trump has stayed surprisingly silent on the issue, the White House signaled it wants to punt the funding deadline into January 2026 in its anomalies request—an ask that aligns with requests from conservatives.

The margin of error for Speaker Johnson is small, as Republicans can afford to lose only two votes after Democrat James Walkinshaw won a special election in Virginia Tuesday to succeed the late Rep. Gerry Connolly. Otherwise, Johnson will need Democrats to help pass any government-funding deal, while the Senate needs at least seven Democrats to join Republicans in order to overcome a filibuster.

Furthermore, some Democrats are drawing red lines around how long the extension of the enhanced tax credits will be. Ways and Means ranking member Richard Neal said that a one-year extension is a nonstarter for him.

“All that means is we get past the next election cycle,” Neal said. “People need some certainty in their lives. There is going to be an explosion in cost increases for a lot of people.”