There’s a congressional tornado coming right at Kevin Warsh, President Trump’s nominee for chairman of the Federal Reserve Board.

How he emerges from its rubble will not only determine whether he becomes arguably the federal government’s most important financial player, but could also have implications for whether the Fed retains its historic independence from political influence.

The indicators of Warsh’s fate are unclear.

He’s unquestionably going to draw more and probably louder opposition than Fed nominees usually attract. But he also has the support of a president whose influence among Republicans remains nearly impenetrable, and he has important ties to more-mainstream Republicans as well.

Warsh needs the votes of 50 senators for confirmation, since Vice President J.D. Vance would break any tie. If Democrats stick together, opposition from four Republicans would derail the nomination.

The nomination first needs approval from the Senate Banking Committee, which has 13 Republicans and 11 Democrats.

The Republican to watch so far is Sen. Thom Tillis, who has been very publicly troubled for months about Trump’s efforts to influence the Fed.

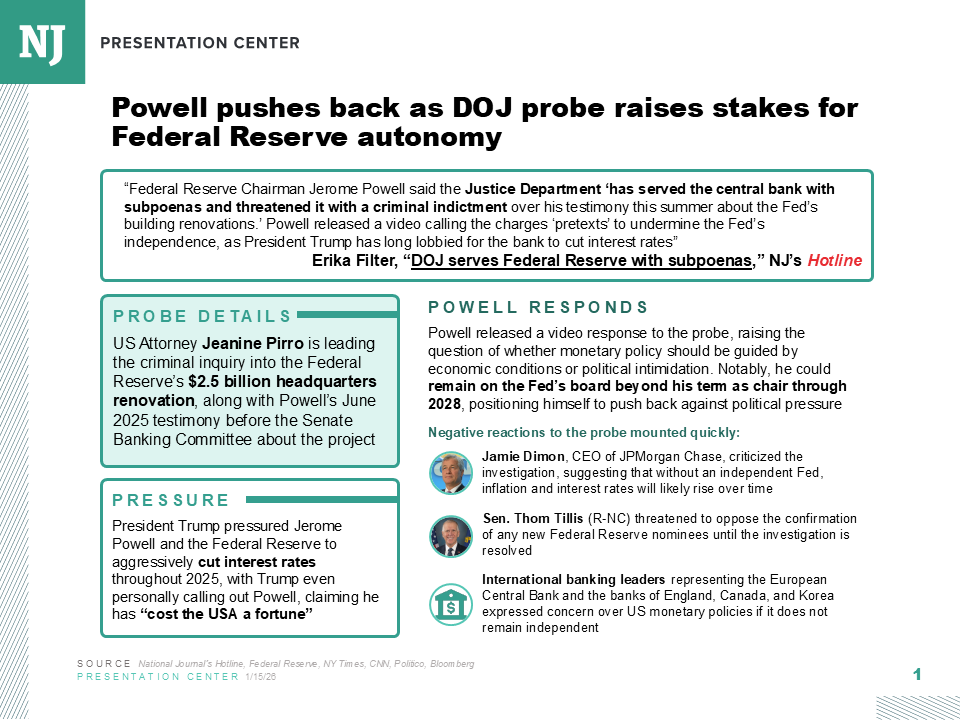

Trump wants interest rates lowered and has pressured the Jerome Powell-led Fed to act more quickly. The Justice Department is conducting a criminal investigation into whether Powell lied to the Banking Committee about Federal Reserve building renovations—an accusation the Fed chair vehemently denies. The administration’s efforts to stifle Powell have infuriated Tillis.

Within minutes of Trump’s announcement of Warsh, the North Carolina Republican tweeted that Warsh is “a qualified nominee with a deep understanding of monetary policy.”

But, Tillis quickly added: ”Protecting the independence of the Federal Reserve from political interference or legal intimidation is non-negotiable."

“My position has not changed: I will oppose the confirmation of any Federal Reserve nominee, including for the position of Chairman, until the DOJ’s inquiry into Chairman Powell is fully and transparently resolved.”

Assuming other senators vote with their political parties, a Tillis no vote would create a tie vote in the committee. Senators are reluctant to consider nominees on the floor in such cases.

Adding to the chorus of skeptics will be Democrats. Banking Committee ranking member Elizabeth Warren is a longtime vocal critic of Trump banking policy.

She kept up that drumbeat when discussing Warsh. “No Republican purporting to care about Fed independence should agree to move forward with this nomination until Trump drops his witch hunts of the current chairman of the Federal Reserve and Governor Lisa Cook,” Warren said.

Trump tried to remove Cook, who was nominated to the board by President Biden. Cook challenged his action. The Supreme Court heard the case last month, with justices signaling they would side with Cook.

Yet Warsh’s prospects are not necessarily bleak.

He benefits from being a well known and respected figure in more-traditional Republican and banking circles, where top officials simply call him Kevin.

Rob Nichols, president of the American Bankers Association, worked with Warsh during the George W. Bush administration. Bush named Warsh to the Federal Reserve Board in 2006—he was confirmed by voice vote—and he served until 2011.

“I know he has a deep understanding of monetary policy, markets, and the important role the nation’s banks play in the economy,” said Nichols, who was assistant secretary for public affairs in Bush’s Treasury Department.

At the U.S. Chamber of Commerce, Suzanne Clark, president and CEO, said.”Kevin is well known to the business community.”

She praised his “years of focus on how we grow the American economy and maintain stable prices for America’s families, and look forward to his confirmation process.”

And Banking Committee Chairman Tim Scott said he was “confident Kevin will work to instill confidence and credibility in the Fed’s monetary policy.”

Also in Warsh’s favor: Markets weren’t jolted Friday by the nomination. The Fed has cut its target interest rates by three-quarters of a percentage point since September, and has signaled two more cuts could be on the way this year.

The key test for Warsh will be navigating the politics, dodging the tornado on the horizon, and answering doubts such as those expressed by Sen. Mark Warner, a senior Banking Committee member.

“It is difficult to trust that any chair of the Federal Reserve selected by this president will be able to act with the independence required of the position,” Warner said, “knowing that this administration will levy charges against any leader who makes interest-rate decisions based on facts and the needs of our economy rather than Trump’s personal preferences.”